level 2

yup, for the 'most' part, with a few exceptions of course, the earlier the city became large, the more extremely cheap areas there are.

But of course, they are areas you don't want to be in,.

For instance the neighborhood John Fetterman 'turned around' as mayor( in pittsburgh area). the last 8 home sales were 315k. thats total, not an average. . 8 houses-315k total.

level 2

Right!?! I don’t feel these statistics are ever very accurate and severely underestimate income needed for homeownership.

Are they even taking into account putting money in savings, saving for retirement, saving for a vacation, medical expenses, childcare costs which many families have, having a car payment, how much food costs have gone up, money needed for home repairs, property taxes that seem to keep going up in many areas, etc?

level 2

Usually these graphs are "to afford the median mortgage".

But the median mortgage (a) is based on much lower interest rates for many homes purchased 2015-2021, and (b) ignores the down payment and closing costs of home ownership, much less the other expenses needed by someone to survive.

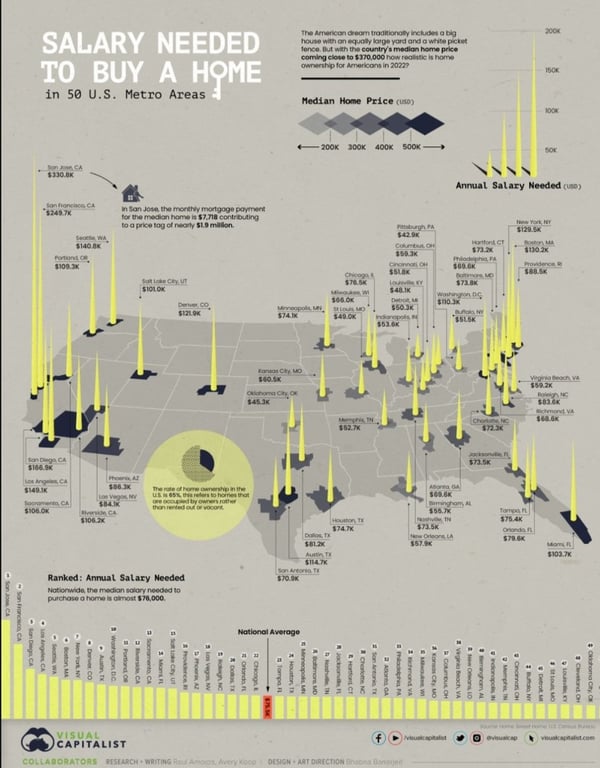

The San Jose example says the median mortgage is $7,718 and median salary is $330,800. 12 months of $7,718 is $92,616, which is near-exactly 28% of $330,800. And 28% of pre-tax income is the max recommended expenditure on a home.

Note, again, that according to the link 28% should include ALL expenses, not JUST the mortgage. Yet this graph is just looking at the median mortgage, and multiplying by 12 for the annual spend, and then dividing by 28% for the median salary necessary to just barely afford the median home in each given city.

So this graph is horseshit even if the numbers are technically accurate, because the reality is that few people making 120k in Denver are actually going to buy a new home, and someone making 120k in Denver owning the median mortgage is just barely affording their payments.

level 2

The chart doesn’t take property taxes, insurance, or revolving debts into account.

level 2

Probably talking about Catskills or something. Houses in NYC hood will be like 600k+.

level 1

I wonder if they're also factoring in the down payment, property taxes, utilities, capital expenditures, insurance, HOA fees and general maintenance. Not to mention, buying a house is one thing. Buying one in a safe neighborhood with a decent school district is another.

level 1

129k to afford a home in NYC? A 1 bedroom right outside the 125th 6 train I guess

level 1

level 1

Home ownership and its consequences have been a disaster for the American people. It's directly related to sprawl, inequality, our infrastructure and cities deterioriting, and the obesity epidemic.

Here's a short video that goes into the const/infrastructure that I found illuminating. We're heavily subsidizing single family homes which are a net drain on finances.

level 1

there’s no way this is right. i make 60k and can barely afford my apartment. sit down.

level 1

All the comments seem to suggest that this chart is wrong and you need more money to buy a house. I think most people just don't understand how to live within their means and make a smart investment such as a buying a home. I live in St. Louis, MO and make significantly less that what is suggested here. A mortgage under $1000 is reasonable for that area. As far as the massive cities like NYC, San Jose, and other CA cities goes, the numbers are probably accurate...most people in these areas rent condos and such for more than what they could buy a house for and assume that because they pay too much rent, these numbers must be wrong.

level 2

It's the median people don't understand how graphs work lol

level 2

The home price for San Jose is inaccurate. Median home price is around $1.2 million not $1.9 million.

level 1

Every time I hear someone on Reddit complain about landlords and housing costs I assume they are in NYC or California and this proves why. If you can’t afford housing just move.